Mathematics of Trading: Uncertainty

Living With Randomness: Why Markets Feel Unpredictable and Why That’s Okay

- Why do markets feel unpredictable even when narratives seem clear?

- What does it actually mean for an outcome to be uncertain?

- What’s the difference between randomness and unpredictability?

- How do simple simulations help us reason under uncertainty?

- How should uncertainty shape the way we make trading decisions?

Markets often feel unstable, chaotic, or contradictory. You can be perfectly aligned with the macro backdrop and still take a loss. You can be totally clueless and accidentally profit.

This isn’t because markets are malicious, it’s because markets live inside uncertainty.

Trading is not the art of prediction. Trading is the art of making good decisions inside an uncertain environment.

What Do We Mean by “Uncertainty”?

Uncertainty means:

You cannot know which specific outcome will happen, but you can understand the set of possible outcomes.

This idea separates:

• prediction (what will happen)

from

• probabilistic reasoning (what could happen & how likely each outcome is).

It’s the shift from certainty mindset → scenario mindset.

Markets Are Not Deterministic

In deterministic systems (a pendulum, a falling ball), the future is fully determined by initial conditions.

Markets do not work this way.

Even if you knew everything:

- all economic data

- all trader positions

- all liquidity

- all incoming news

you would still not know what price will do next.

Because markets depend on:

- human reactions

- evolving expectations

- feedback loops

- liquidity cascades

- algorithmic interactions

Even perfect information cannot eliminate uncertainty.

Uncertainty isn’t an obstacle, it is the medium markets operate in.

Outcomes as the Building Blocks of Uncertainty

Before using formulas, let’s use intuition.

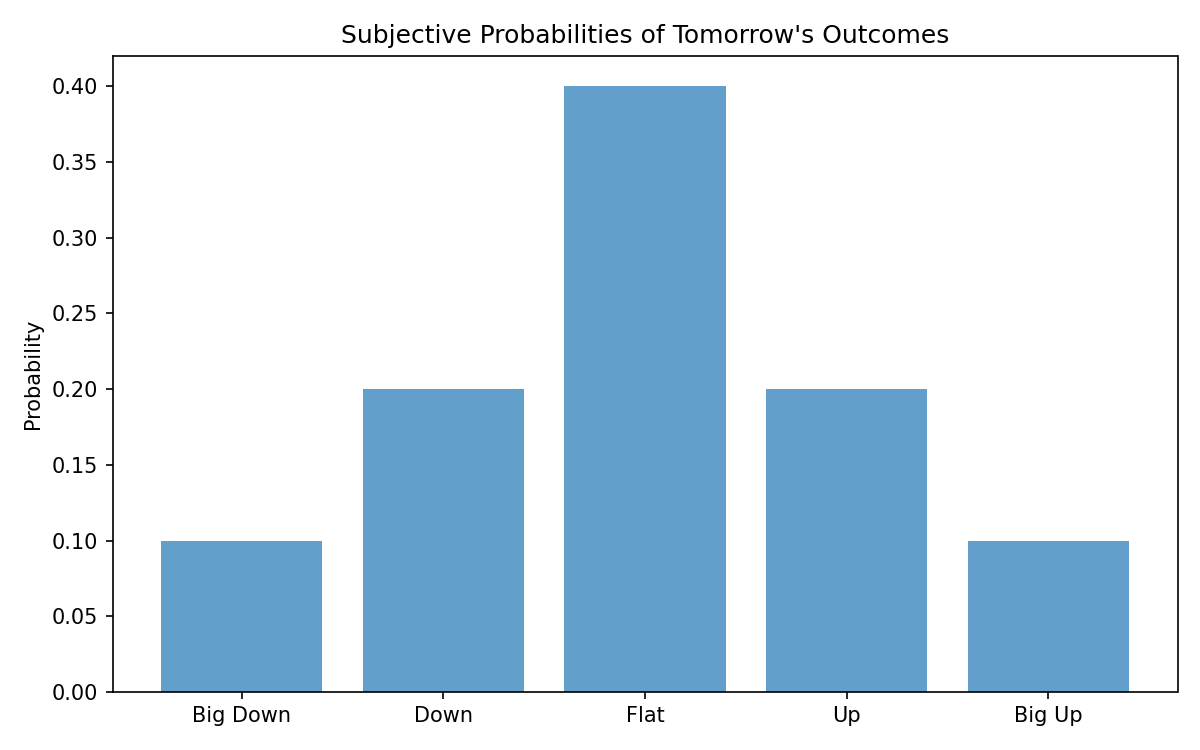

Tomorrow’s return for an index might be:

- big down

- down

- flat

- up

- big up

Each outcome has some (unknown) probability.

The future is never a single number. It is a cloud of possible states.

Risk vs Uncertainty

These words are often mixed up, but they are not the same:

Risk

You know the probabilities (or can estimate them). Example: a fair coin, a dice roll, a pricing model.

Uncertainty

You do not know the true probabilities, or the probabilities shift over time. Example: tomorrow’s S&P return.

Beginners treat markets like casinos (fixed odds). Professionals treat markets as dynamic environments where the odds themselves vary.

Uncertainty ≠ Pure Randomness

Markets often look random, especially on short timescales but they are not random in the way a coin is random.

Coin randomness comes from physics. Market uncertainty comes from hidden variables:

- order flow

- crowd behavior

- liquidity stress

- macro expectations

- algorithms interacting

- structural constraints

Some of these create:

- trends

- momentum

- mean reversion

- volatility clusters

- anomalies

Others create:

- noise

- randomness

- tail events

Markets are mixtures of structure and noise. Understanding this blend is essential for understanding opportunity.

A Simple Mathematical Model of Uncertainty: Random Walks

A random walk is the simplest model of unpredictable movement:

Even with such a simple structure, outcomes quickly become hard to predict.

Zoom in: chaos. Zoom out: still chaotic.

Even trivial randomness produces unpredictable paths.

Uncertainty Grows With Time

A key mathematical fact:

The expected value stays the same. But the variance increases:

Meaning:

- tomorrow is a little uncertain

- next week is very uncertain

- next year is wildly uncertain

Long-term forecasts fail because uncertainty compounds.

Uncertainty expands faster than intuition expects.

Many Possible Futures: The Fan of Outcomes

At every moment, the future branches. After 20 steps, there are more than a million possible price paths.

The gap between possible futures widens over time. This widening explains:

- losing streaks

- unexpected reversals

- sudden volatility

- why specific predictions fail

Uncertainty has structure, but not predictability.

Good Decisions Can Still Lose Money

This is one of the hardest lessons:

A good decision can have a bad outcome. A bad decision can have a good outcome.

One outcome tells you nothing. Only repeated decisions under uncertainty reveal quality.

This sets up the next module:

Expected Value — the math of making good decisions across uncertain outcomes.

Why Emotion Distorts Perception of Uncertainty

Humans are not built for randomness. Uncertainty creates:

- fear during drawdowns

- overconfidence after wins

- impulsive reactions

- hesitation

- FOMO and panic exits

These emotional reactions contribute to:

- volatility spikes

- temporary mispricings

- liquidity gaps

- overreactions and underreactions

And these distortions are where opportunity lives.

If markets were predictable, edges would disappear.

Working with Uncertainty Instead of Fighting It

Beginners try to eliminate uncertainty:

- adding more indicators

- waiting for perfect signals

- wanting certainty before acting

Professionals do something else:

- accept uncertainty

- operate with incomplete information

- think in probabilities

- focus on EV

- manage risk

- survive variance

You don’t remove uncertainty. You become someone who can function inside it.

Key Takeaways

- Markets are uncertain by nature, and always will be

- Outcomes are random, but randomness has structure

- A single outcome is meaningless; distributions matter

- Variance grows with time, widening the future

- Good decisions can still lose money

- Emotional reactions to uncertainty create opportunity

- Everything coming next — EV, edge, distributions, drawdowns — depends on understanding uncertainty